Contact Us

To provide feedback on the Community Policing Dispatch, e-mail the editorial board at CPDispatch@usdoj.gov.

To obtain details on COPS Office programs, publications, and resources, contact the COPS Office Response Center at 800-421-6770 or AskCopsRC@usdoj.gov

U.S. Department of Justice

Office of Community Oriented Policing Services

Washington, DC 20530

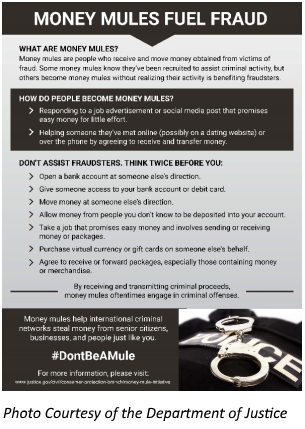

A growing number of American businesses and consumers, particularly seniors, are targeted by attempts to swindle them out of their profits and nest eggs. Many of these scams and frauds originate overseas. In romance scams, fraudsters peddle fake affections and then implore their victims to send them money for feigned emergencies. In lottery fraud, callers congratulate those who answer their cold calls, promising large cash prizes in exchange for “fees” needed to secure the money. And in business email compromise schemes, fraud rings send companies fake invoices or email communications asking for payments. Although the schemes vary, their perpetrators share a common challenge: convincing U.S.-based individuals—who have generally been told that they are talking to someone formerly or currently living in the United States—to send money to a foreign bank account. For many bad actors the answer to that problem is the use of money mules.

Money mules are U.S.-based individuals who move funds from victims to other actors, often those who are involved in perpetrating the fraud. Some money mules know that their actions facilitate criminal conduct. Others may continue their activity in spite of warning signs, such as repeated bank account closures, nonsensical explanations from their contacts, or warnings from financial institutions or law enforcement. A significant number of people, however, serve as money mules without being aware that their activity is harming other people; many of these individuals are themselves victims of scams, especially romance fraud and lottery scams. Regardless of whether or not someone is aware that their activity moves money from victims to perpetrators, the result is the same: money moves out of victims’ accounts into fraudsters’ pockets.

Money Mules Fuel Fraud

Money mules move money for a wide range of fraud schemes, including romance fraud, lottery fraud, person-in-need scams (sometimes known as “grandparent scams”), technical support fraud, government imposter scams, business email compromise scams, and fraud targeting government funds earmarked for pandemic relief, including unemployment funds and Payment Protection Program funds. By receiving victim funds, money mules not only obfuscate the flow of fraud funds, they also equip fraudsters, especially those based overseas, with a U.S.-based bank account or address to which victims can direct payments, simplifying the process for victims to send money and allowing the fraudster to maintain the pretense that, for instance, they are a lottery or government official.

Money mules move money for a wide range of fraud schemes, including romance fraud, lottery fraud, person-in-need scams (sometimes known as “grandparent scams”), technical support fraud, government imposter scams, business email compromise scams, and fraud targeting government funds earmarked for pandemic relief, including unemployment funds and Payment Protection Program funds. By receiving victim funds, money mules not only obfuscate the flow of fraud funds, they also equip fraudsters, especially those based overseas, with a U.S.-based bank account or address to which victims can direct payments, simplifying the process for victims to send money and allowing the fraudster to maintain the pretense that, for instance, they are a lottery or government official.

Recognizing Money Mule Activity

Money mule activity varies widely. At times, money mules simply agree to use their accounts to send and receive funds. Other money mules open bank accounts at someone else’s request; these accounts receive and are used to forward victim funds. Still others may receive or forward packages containing cash or assist with laundering gift cards or virtual currency.

When a person starts acting as a money mule, their financial habits may change significantly. For instance, they may quickly move money by depositing or withdrawing large amounts of cash or currency. Or, they may start purchasing a large number of gift cards or start prolifically using virtual currency.

Often law enforcement will become aware of potential money mule activity in one of two ways: either by private industry—such as financial institutions, money service businesses, or locations that sell gift cards—recognizing suspicious activity, or by victims of scams identifying the person in the U.S. to whom they sent money.

Taking Action: A New Approach

Confronted with the growing problem of the use of money mules by transnational criminal organizations, for the past three years a group of federal law enforcement agencies have coordinated an annual Money Mule Initiative, focusing their efforts over an approximately two-month time period on disrupting fraud schemes by targeting money mule activity. The results of this year’s effort, which were announced on December 2, 2020, demonstrate how widespread money mule activity is: Led by the Department of Justice, the FBI, and the U.S. Postal Inspection Service, law enforcement took action against approximately 2,300 money mules, in every state in the country. During the Initiative action period, 35 individuals were arrested or charged and the government brought over 30 civil or administrative actions. The majority of the money mules interdicted by law enforcement received warning letters.

Confronted with the growing problem of the use of money mules by transnational criminal organizations, for the past three years a group of federal law enforcement agencies have coordinated an annual Money Mule Initiative, focusing their efforts over an approximately two-month time period on disrupting fraud schemes by targeting money mule activity. The results of this year’s effort, which were announced on December 2, 2020, demonstrate how widespread money mule activity is: Led by the Department of Justice, the FBI, and the U.S. Postal Inspection Service, law enforcement took action against approximately 2,300 money mules, in every state in the country. During the Initiative action period, 35 individuals were arrested or charged and the government brought over 30 civil or administrative actions. The majority of the money mules interdicted by law enforcement received warning letters.

The warning letters used by law enforcement to curb money mule activity contain simple, clear language that inform the recipients that law enforcement believes they have been facilitating a fraud (for instance lottery fraud), briefly explain how the fraud scheme works, and warn the recipient that continuing to engage in the activity could have substantial criminal or civil repercussions. Agencies often ask the recipient to sign the letter to acknowledge its receipt.

The vast majority of people who receive a money mule warning letter stop moving money for fraud schemes. And when people don’t stop the behavior, additional law enforcement activity is simplified, as the government can demonstrate the person was warned they were engaging in fraud scheme and continued in spite of that warning.

Join the Effort

If you encounter money mule activity, consider whether by taking action, even by doing something as simple as an interview and warning letter, you can disrupt the flow of victim funds to fraudsters.

When money mule activity has been identified, the first step is to determine the extent of the person’s activity and surmise whether they are aware that their actions are assisting fraud. Before taking any action, however, deconfliction is key. Because money mules play a critical role in the financial infrastructure for fraud, take efforts to ensure that your actions won’t interfere with someone else’s investigation.

For money mules who appear to be complicit or know their activity is part of a fraud scheme, a full criminal investigation may be warranted. If, however, you don’t have capacity for a full investigation or it appears a less aggressive approach is warranted, consider interviewing the individual and serving a warning letter. Document that warning, and, if possible, take steps so you’ll be alerted if the person continues the money mule activity.

Community Engagement

Fraudsters rely on money mules, and one of the effective ways to disrupt that reliance is for people to recognize they are being asked to facilitate fraud and simply refuse to participate. When you are engaging with community members and industry partners on the subject of frauds and scams, consider including a discussion of the signs of money mule activity. Educated consumers can better protect themselves and their communities, and industry partners can take steps to disrupt schemes before they harm more victims.

Additional Resources

Subscribe to Email Updates

To sign up for monthly updates or to access your subscriber preferences, please enter your email address in the Subscribe box.